restaurant food tax in pa

The tax on restaurant food is almost always in that states Sales and Use Tax plus whatever the city or countys sales tax is on top of that. Meals and prepared foods are generally taxable in Pennsylvania.

Estia Greek Restaurant Greek Mediterranean Cuisine Philadelphia Pa 19102

Groceries clothing prescription drugs and non-prescription drugs are exempt from the.

. The minimum combined 2022 sales tax rate for Philadelphia Pennsylvania is 8. What is the tax on restaurant food in Philadelphia. Depending on the type of business where youre doing business and other.

Where in Pennsylvania do you pay 65 percent sales tax. While Pennsylvanias sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales. Compare purchase orders to revenue.

The tax also covers any syrups or concentrates that are used to make a. Not all Retail Food Facilities in Pennsylvania are under the jurisdiction of the PA Department of Agriculture PDA. The sale of food and nonalcoholic beverages - by a caterer or eating establishment in Pennsylvania is subject to tax.

Pennsylvania doesnt have a 65 percent sales tax. Are Food and Meals subject to sales tax. Restaurant owners who pay business taxes through their personal tax returns usually cant deduct these charitable donations unless they itemize deductions.

Six counties - Allegheny Bucks Chester Erie Montgomery and Philadelphia. This is the total of state county and city sales tax rates. The sale of food and beverages including candy and gum by a caterer is subject to tax.

Pre-packaged beverages made with natural sweeteners such as agave honey or stevia are also covered by the tax. Generally tax is imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the purchaser or consumer when. Pennsylvania has a 6 statewide sales tax rate but also has 68 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0166.

The National Restaurant Association states that a restaurant income tax rates can reach as high as the 30 range depending on business structure sole proprietor LLC S-Corp. A Pennsylvania Meals Tax Restaurant Tax can only be obtained through an authorized government agency. What is the tax on restaurant food in.

This includes food sold by an establishment selling ready-to-eat food for consumption on or off the. PA law states that sales tax will be imposed on food and beverages for consumption on or off the premises or on a take-out or to go basis or delivered to the. The tax is imposed upon the total purchase price billed to the purchaser including separately stated.

Restaurant meals and general purchases are subject to an 8 percent sales tax whereas liquor is subject to a 10 percent sales. If whiskey costs 5 per shot each bottle should generate 85100 in revenue. You pay the tax on everything except clothing and food.

In general the sale of food and non-alcoholic beverages by a caterer or eating establishment in Pennsylvania is subject to tax regardless of whether the customer is dining in. If three months worth of purchase orders are. Below are some of the most popular.

The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634. The 8080 rule applies when 80 of your sales are food and 80 of the food you sell is taxable. SALES TAX IN THE RESTAURANT INDUSTRY WHAT IS TAXABLE.

If this rule applies to you and you do not separately track sales of cold food.

Sicily Pizza Restaurant Iii Menu In Bethlehem Pennsylvania Usa

Everything You Need To Know About Restaurant Taxes

State And Local Sales Tax Rates Midyear 2021 Tax Foundation

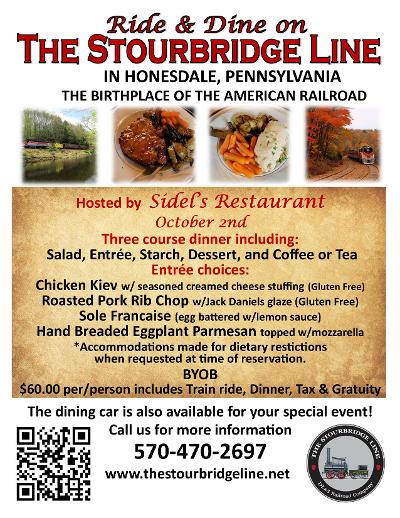

Italian Restaurant In Scranton Sidel S Restaurant

Everything You Need To Know About Restaurant Taxes

Sales Tax On Grocery Items Taxjar

Pittsburgh Pa Bae Bae S Kitchen Restaurant Book Review Cordially Barbara

2022 Sales Tax Holidays Back To School Tax Free Weekend Events

What You Can Get Cheap Or Free On Tax Day 2017 The Denver Post

Taxes On Food And Groceries Community Tax

The Importance Of Restaurants To Local Community Cumberland Area Economic Development Corporation

Pennsylvania Licenses And Permits For Restaurants And Bars

Spice Kitchen Stroudsburg Pa Facebook

Is Food Taxable In North Carolina Taxjar

Restaurants Florida Sales And Use Tax Handbook

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Pennsylvania Sales Tax Which Items Are Taxable And What S Exempt